Washington’s Crypto Power Grab – a Game-Changer or a Disaster?

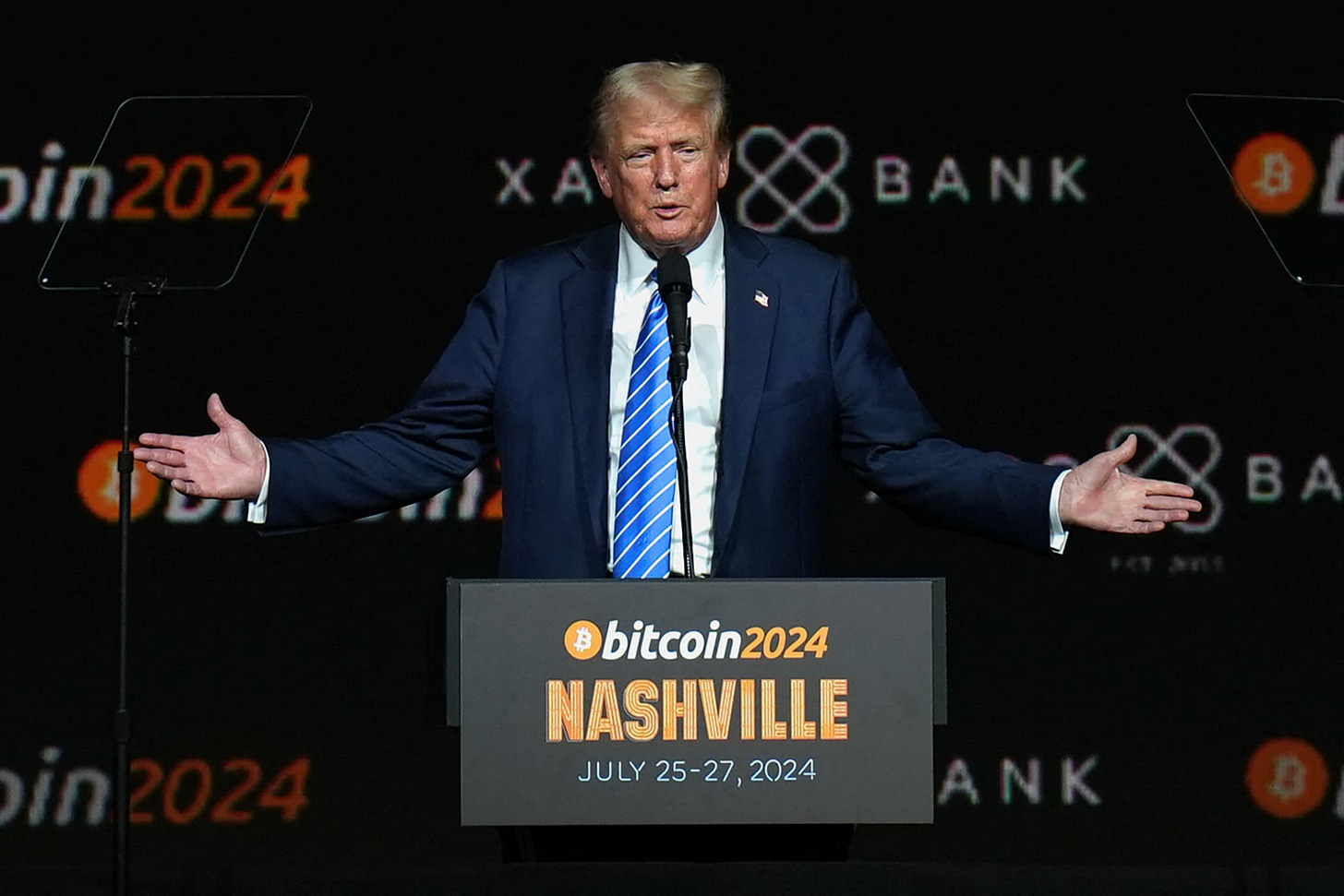

Trump is pushing to make the U.S. the “crypto capital of the world.” But who really wins?

Just a few years ago, folks were laughing at cryptocurrencies. Now, the power players in the industry are rubbing shoulders with President Trump at the White House.

Crypto has gone from a joke to a serious financial tool.

Last week, President Donald Trump signed an executive order to create a national stockpile of Bitcoin and other digital currencies, aiming to make the US the “crypto capital of the world.”

He followed this with the first-ever White House Crypto Summit, bringing together top people from the crypto world. Key leaders like Commerce Secretary Howard Lutnick, Treasury Secretary Scott Bessent, and “crypto czar” David Sacks all have strong connections to the industry.

But what does this mean for regular people? Will it make crypto easier to use, or are there risks? For women, especially those new to digital finance, this raises questions about how we might benefit from this push to crypto – and whether it could affect our financial privacy and independence.

Let’s dive into what all this crypto buzz is really about.

Where did Bitcoin come from?

Bitcoin (BTC) was the first digital currency and is still the most valuable and well-known today.

The concept behind what would eventually become Bitcoin was first shared in 1998 by computer engineer Wei Dai. He suggested a new type of money that doesn’t rely on banks or governments. Instead, it uses cryptography, a method of securing and protecting information using codes.

Unlike cash, bitcoins and other cryptocurrencies don’t exist in the real world as physical bills or coins. Bitcoins are directly transferred from one person to another.

Bitcoins are mined, not minted

The way new bitcoins enter circulation is called Bitcoin mining. It’s a process that helps build and maintain Bitcoin’s digital record, called a blockchain, which is a digital, decentralized, public ledger. It also verifies new transactions to keep the network running smoothly.

Mining for Bitcoin takes significant time and energy. Powerful computers have to solve incredibly difficult math problems to create (or "mine") a single Bitcoin. These problems come from the complex algorithms designed to keep the Bitcoin network secure. To give you an idea of the scale, mining one Bitcoin can take thousands of computers working together for weeks, or even months, using enough electricity to power an entire household for that same time. The first computer or pool of computers to find the solution earns the next batch of bitcoins (that’s incentive for doing it), and the process starts again.

Bitcoin mining will end when there are 21 million bitcoins in total. This limit was set by Bitcoin’s creator, a mysterious person (or group) known as Satoshi Nakamoto. There are more than a million still left to mine.The last bitcoin is expected to be mined by the year 2140. After that, there will be no more new bitcoins, which in theory will make the existing ones more valuable.

Today, Bitcoin’s value comes from three main things: how much people want it, the fact that there’s a limited supply, and its secure, decentralized system. What some call a risky gamble now appears to be moving in the direction of becoming part of a stable financial system — something that’s already starting to happen as big investors and even the U.S. government treat Bitcoin as a valuable asset.

Trump’s crypto

In September 2024, just before the presidential election, Trump and his family members – including sons Eric, Donald Jr., and Barron – launched World Liberty Financial (WLF).World Liberty says, “We’re leading a financial revolution by dismantling the stranglehold of traditional financial institutions and putting the power back where it belongs: in your hands.”

Crypto firms donated at least $10 million into the Trump inaugural fund for a gala in January. The biggest donors all had a seat at the table for the recent crypto summit, and his campaign also solicited crypto on its website.

WLF made aggressive moves in crypto ahead of last week’s summit, grabbing $20 million worth of it, raising eyebrows over conflicts of interest, and adding to concerns about the influence the crypto industry is buying in Washington.

Before his return to the White House in January, both the president and his wife Melania launched memecoins that made them at least $350 million on the sale of the coins ($Trump and $Melania) alone. In January, the value of the coins on paper was about $30 billion (based on a value of $30 a coin) but have since slipped by two-thirds.

Memecoins are a type of cryptocurrency named after trends, jokes, or anything funny or popular. (The Preamble talked about them in January.) Because of that, memecoins are considered risky and volatile investments.

Folks on Capitol Hill are taking notice. Sen. Elizabeth Warren and Rep. Jake Auchincloss sent letters to several government agencies, including the Office of Government Ethics and the Treasury Department. They asked how these groups plan to handle concerns about the new $Trump and $Melania memecoins. Their concerns include possible scams, corruption, foreign influence, and President Trump’s potential conflicts of interest.

Some critics worry that these tokens represent a threat to national security. It would be possible for foreign agents to buy large amounts of the token as leverage over Trump’s policy decisions. They could buy them to bump up the value to win Trump’s favor or they could threaten to sell them off to crash the price. They could also use cryptographic techniques to conceal their identity to everyone in the world but Trump.

Digital Asset Stockpile

In January, a few days after taking office, Trump signed an executive order with the stated goal of strengthening American leadership in digital financial technology and establishing the Presidential Working Group on Digital Asset Markets.

The order outlines five main goals to promote the responsible growth of digital finance, but it also makes a big change by revoking earlier guidance on how the U.S. government would handle digital currencies. This space is largely unregulated, and without that guidance, there’s less clarity on how the government will oversee crypto moving forward.

One goal of the order is to protect people's right to use blockchain and crypto, ensuring individuals and businesses can legally use these technologies, send money without censorship, and control their own digital assets. It also encourages the growth of stablecoins– cryptocurrencies tied to the U.S. dollar– to help strengthen the dollar worldwide.

Libertarian groups like the Cato Institute fear government-issued digital currency would undermine financial privacy and allow Washington to keep closer tabs on our transactions. They argue that it would give the government more control over our transactions, making it easier for them to track what we’re buying. These groups also fear that a digital currency could let the government stop us from making certain purchases it doesn’t agree with.

Last week, the president signed another executive order, creating the Strategic Bitcoin Reserve and United States Digital Asset Stockpile.

Why create a Strategic Bitcoin Reserve?

Strategic reserves are government-controlled stockpiles of important resources. They’re usually created to protect a country’s security or economy. One well-known example is the U.S. Strategic Petroleum Reserve (SPR), which stores crude oil in case there’s a supply problem. The US and other countries also keep reserves of gold and foreign money to help keep their economies stable.

By creating a Strategic Bitcoin Reserve, the US is treating Bitcoin like these traditional reserves. This move gives more credibility to Bitcoin, even though it's still a new and unpredictable type of asset that many people are unsure about.

Experts estimate that the U.S. government holds around 200,000 bitcoin, largely due to seizures as part of criminal investigations, though no full audit has been done. Trump’s order requires a full review of all federal digital assets and bans selling Bitcoin from the reserve, making it permanent. The value of the existing bitcoin owned by the US government will fluctuate with the market, but it’s worth about $16 billion at today’s prices.

The Digital Asset Stockpile will be managed by the Treasury Department.

The Strategic Bitcoin Reserve isn’t without controversy. Unlike oil, which is key for energy, or gold, which has been valuable for thousands of years, Bitcoin is still unpredictable and highly speculative – at least for now.

Still, the U.S. dollar is the backbone of global financial markets. It’s held by nations because of its stability and value. At least right now, holding Bitcoin does little to boost the nation’s financial security. But the creation of the reserve and stockpile could help in other ways, like the management of the nation’s digital holdings. Sacks said on Friday that taxpayers have missed out on "over $17 billion of value" because previous administrations didn’t make use of the Bitcoin already held by the U.S. government.

Sacks said, “We've had this very ad hoc strategy where we just would sell the bitcoin, sort of almost willy-nilly, and we sold about half of it. We only made about $400 million. Today, that bitcoin would have been worth over $17 billion, so the American taxpayer lost out on over $17 billion of value.”

Sacks called the new reserve a "digital Fort Knox for cryptocurrency," and the president said he wants the U.S. to become the "crypto capital of the world."

In a post on X, Sacks said, “The Secretaries of Treasury and Commerce are authorized to develop budget-neutral strategies for acquiring additional bitcoin, provided that those strategies have no incremental costs on American taxpayers.”

Sacks said that means that they are only "allowed to buy more if it doesn't add to the deficit or the debt." That could change in the future.

However, because there’s no clear plan yet for how the reserve will be managed, some worry that political motives, secret deals, or government mistakes, like the one Sacks said cost taxpayers $17 billion, could hurt Bitcoin’s reputation as an independent and secure asset.

Supporters of the Bitcoin reserve say it boosts Bitcoin’s importance and shows that the US is leading the way in digital asset policy. Some think this move could inspire other countries to create their own Bitcoin reserves, speeding up its acceptance by major financial institutions.

Some critics say Bitcoin has no real value because it’s digital and isn’t used in manufacturing. But what gives something value can change depending on what people need at the time.

Trump’s forays into digital currency, and establishment of a reserve and stockpile, could be used to score points and fill the pockets of his crypto donors.

It could also encourage big companies and central banks to buy Bitcoin, make it harder to get as governments hold more of it, and help Bitcoin be seen as a serious investment, like gold or bonds.

One thing is clear: Bitcoin and other digital currencies appear to be here to stay. The Trump administration is betting on crypto.

I feel like my late 89 year old grandmother trying to learn how to use a smart phone when I read about digital currency.

I just don’t understand it.

Oof. Sacks' claim that taxpayers "lost out on over $17 billion of value" reveals a concerning mindset. This is the classic thinking of someone with a gambling problem. Any financial advisor would tell you that labeling FOMO as concrete "losses" is fallacious. By this logic, we've all "lost" billions by not buying winning lottery tickets. And this is the crypto and AI czar. Not very comforting.

The New York Times' March 3rd piece "Trump Faces Blowback Over Plans for Crypto Reserve" shows that many people are concerned. The backlash is coming from all directions—even Republicans question spending on volatile assets instead of debt reduction. As conservative investor Joe Lonsdale aptly put it: "It's wrong to tax me for crypto bro schemes."

The conflicts of interest are glaring. Trump profited from $Trump memecoins before taking office, and now creates policies benefiting those assets.

And as mentioned by Sharon, most alarming is the national security risk. Foreign entities could buy large token positions as leverage over US policy decisions—threatening to sell and crash prices or buying more to curry favor. Or maybe “could” is the wrong word… why wouldn’t they?

This appears to be what $130 million in crypto industry campaign contributions buys. The proposed Senate bill would direct the government to purchase one million Bitcoins—approximately $92.6 billion of taxpayer money into speculative assets.

Thank you Sharon for writing what must have been an incredibly difficult article to explain everything so succinctly. I cannot pretend to understand everything written here, but it definitely helped to make sense of it. I wonder, and maybe this is a future topic, how does this fit in with American history, in terms of politicians being able to set the rules that directly enrich themselves for assets they own? It is kind of the definition of corruption, isn't it? But I won’t pretend that it’s the first time it has happened.