Would You Pay 3% in Taxes? Here's How Billionaires Do It

Billionaires probably pay a lower tax rate than you do. Some even pay $0 in income taxes, despite their net worth increasing exponentially each year.

Last week, I fielded dozens of questions about how most of us pay so much of our paychecks in federal taxes, while the people who make the most pay tiny sums. So how exactly do billionaires walk away forking over little more than 3% per year?

Keep reading to find out.

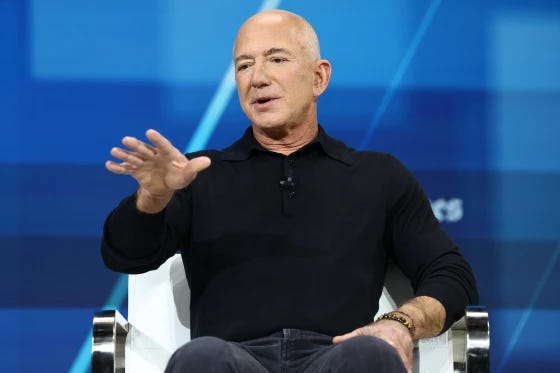

In 2021, a ProPublica report showed the richest Americans – Warren Buffett, Jeff Bezos, Michael Bloomberg, and Elon Musk – all paid an effective tax rate no greater than 3.3% of their wealth from 2014 to 2018. Some even paid close to zero in taxes.

Here’s how they do it

The US tax code is intentionally complex, and billionaires have the means to learn how to exploit the loopholes. (I mean… you can do it too, if you want, but the average American simply doesn’t have the resources to make this work for them.) These billionaires (and their financial advisers) are extremely skilled at using tax laws to their advantage.

Here are three ways billionaires can keep their tax bills low:

They borrow money from themselves. The average person might think, “If someone wants to buy a house, they can just sell their stocks to get the money.” But if you do that, you’ll owe taxes on the money you made from the sale. There is another way: the wealthy borrow money from themselves, tax free.

In much the same way as someone can borrow from their 401K, billionaires borrow from their own portfolios with a line of credit. And then they can spend that money on whatever they want, tax free, because the government does not tax loans. (If you’ve ever purchased a home or a car, you know that you didn’t have to declare the amount the bank agreed to loan you as income that year.)

Bank loans like mortgages have a lot of regulations about how that money can be spent (you can’t take out a mortgage, get a huge check, and then just spend it at the mall), using a line of credit against your portfolio can be used to pay for everything from gas station snacks to an 8th Rolls Royce.

When they go to repay this loan, which is often at a lower rate than one might get from a bank, they are simply putting money back into their own account, to be borrowed again another day, tax free.

Billionaires borrow money from other people. Some billionaires would sooner go bankrupt than to spend their own money on something. It’s one reason why billionaires like Donald Trump still borrow money for their real estate deals. It’s not that they couldn’t write a check for $100 million if they wanted to, it’s that in order to come up with the cash, they would have to sell something and pay taxes on it.

Instead, it makes far more sense to take out a loan, using their assets as collateral, and pay a much lower rate for interest than they would pay in taxes. Meanwhile, the value of their assets only continue to grow, because they held onto it rather than selling it.

And this doesn’t even mention how billionaires borrow money to invest so they can get huge returns and then write off the interest they pay on the loans.

They also take small salaries. And I mean sometimes even $1 a year, taking the rest of their compensation in stocks or stock options. They take home very little pay on paper, all while their net worth accelerates faster than you can imagine.

Daniel Shaviro, a New York University law professor and tax policy expert, told The Preamble that we’d be surprised at “how much of [billionaire’s] economic income doesn’t take the form of W-2 wages, even if they work full-time.”

He said, if they own a company, they can choose to pay themselves a small salary. This way, instead of paying personal income taxes, which are a higher tax rate, the company pays taxes at a lower corporate rate (or sometimes not at all).

And they don’t need large salaries on paper, because they can live tax free off of lines of credit from their assets.

They often show losses on their taxes. Some billionaires, like Jeff Bezos, who in 2011 was worth $18 billion, said that he lost enough money on some of his investments that it offset everything he would have had to pay in taxes. In fact, that year, he got a $4,000 tax credit for his children.

Another year, he reported $46 million in income, but then also said he took losses on some of his other investments, and the losses canceled out his income, resulting in $0 owed.

Must be nice, right?

Some billionaires, like Warren Buffet and Mark Cuban, have long said they advocate for reforming the tax system so that people like them pay more. Some members of Congress and President Biden have floated plans to have a minimum tax of 15% on billionaires, which is still a lower percentage than most of us are paying.

But as of this writing, structurally altering the tax code to force billionaires to pay the same rates as everyone else doesn’t appear to be on the table.

I know there are some tax professionals, investment bankers, and financial planners here. Let us know in the comments other tax loopholes the rich use to pay 3% or less!

Fascinating timing on this article, Sharon. Now that we have the "world's smartest billionaire" slashing government spending "with a chainsaw," it's the perfect moment to reconsider our strange admiration for billionaire tax avoidance. After all, if the government is now slimmed down to just the programs and infrastructure that keeps our country functioning, there couldn’t possibly be a charitable organization more worthy of their donations — but unlike a charity, paying their taxes is now, according to their own logic, more like paying a bill of what they actually owe. Right?

For too long, we've celebrated these tax schemes as brilliant financial wizardry instead of calling them what they are - civic freeloading. Every dollar these billionaires don't pay is either coming directly from our wallets or being added to the national debt they pretend to care about. If there's truly no more government waste to cut, what excuse do they have left?

The most absurd part is how many of these same individuals brand themselves as generous philanthropists while giving away pennies compared to what they hoard. They control foundations that distribute tiny fractions of their wealth while their fortunes continue to balloon through the very tax avoidance schemes you've described.

Maybe it's time we changed how we talk about this. What if we started publicly shaming billionaires who use these tactics rather than admiring their "savvy"? What if financial media stopped reporting on "tax efficiency" as a positive and started reporting on "civic contribution" instead? What if we celebrated the wealthy who willingly pay their fair share and created social consequences for those who don't?

We have more power than we think. Public pressure has changed corporate behavior on environmental and social issues - why not taxation? Perhaps the most effective bill we can send billionaires is a social one.

Imagine a website called "SendEmTheBill.com" or something (help me with some ideas please) that tracks these ultra-wealthy individuals in a simple grid: their current net worth, what they actually paid in taxes, what they would have paid if taxed at the same rate as someone earning $100,000, and the difference between the two. Finally, a "Send Them The Bill" button that publicly challenges them to contribute this difference to pay down our national debt or fund critical public services. Those who refuse get prominently labeled as "Tax Dodgers" or "Civic Thieves" on the site's leaderboard. Or how about we revive that “Welfare Queen” slur and put it to actual good use? Social media campaigns could amplify these labels until they become part of these billionaires' public identities. Nothing motivates the image-conscious wealthy quite like public accountability. Hit em where it hurts: their legacy.

I would also encourage people to really understand that we have a lot of data now to show exactly what the rich and corporations do with the income they don’t pay in taxes. They use it to further enrich themselves. They continue to increase their wealth while wage growth for THE VAST MAJORITY of us remains unchanged. Our labor funds their increased wealth. It is high time for some class solidarity in this country. HIGH TIME. We need to understand that taxing the rich benefits 99% of us. We need to campaign finance reform. It. Is. Time.